Singapore, Oct 2017 – While the FTSTI suffered a minor correction of -7 points from 3,226 to 3,219 or -0.22%, SREITS remained almost immune – it held steady from 2Q2017 performance.

As in our quarterly REITS class, we have always highlighted that the ability of SREITS to deliver outperformance is and should not be based on growth in revenue or NPI or Distributable Income, but on the DPU. This last quarter’s set of results clearly underscore what we have been teaching.

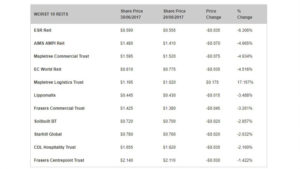

An analysis of the quarter’s Worst Performers revealed that that with the exception of Mapletree Commercial Trust, all Worst-10 SREITS delivered either YoY OR QoQ DPU negative growth.

Not surprisingly, the Worst-10 SREITS namely ESR Reits, AIMPS AMPI and EC World Reit all registered the worst drops in DPU! Clearly, SREITS price movements are a great reflection of their underlying performances.

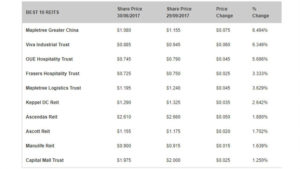

A similar analysis of the quarter’s Best Performers revealed that that with the exception of Ascott Reit and Manulife Reit, all Top-10 SREITS delivered either YoY OR QoQ DPU positive growth.

Again not surprisingly, the top 3, namely Mapletree GCC, Viva Industrial Trust and OUE Hospitality Trust had surprised market with their above-average DPU announcements.

ABOUT BLOGGER

Mr Gabriel Yap was an eminent stockbroker and investment banker who retired in 2009 to devote himself to philanthropy. He is well-known as the Investment Guru, having being regularly interviewed in the news media like Channel News Asia, Bloomberg TV, CNBC, MediaCorp Radio. Mr Yap has been in the judging committee for many prestigious awards including Fortune Times. He has not only lectured for 30 years but also sat in the EXCO of the 13th Council of the Association of Small & Medium Enterprises, ASME. Served in the EXCO of the Securities Investors Association of Singapore, SIAS. To date, he shutters between his homes in Europe, Melbourne and Singapore