Confidence among Asian companies held near three-year lows in the first quarter as the US-China trade tension is dragging on, pulling down a global economy that is already on a downward path, a Thomson Reuters/INSEAD survey has found.

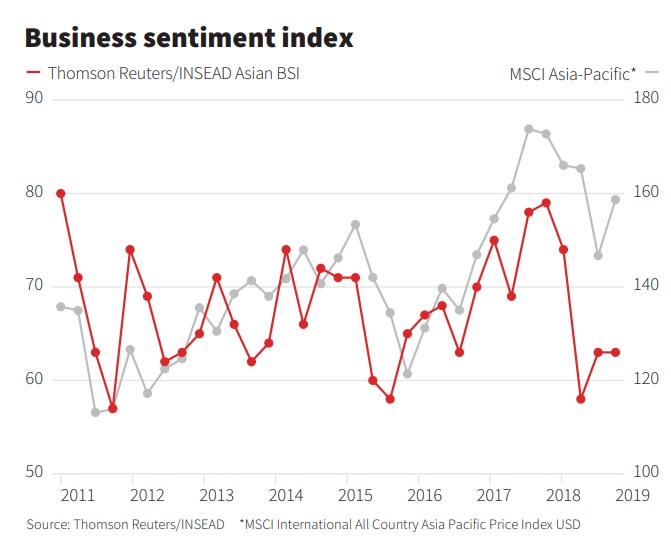

The survey, called Asian Business Sentiment Index which tracks firms’ six-month outlook, was flat in the March quarter from the previous quarter’s 63, compared with a near three-year low of 58 set in the September quarter.

A reading above 50 means optimistic respondents outnumbered pessimists, but the latest index still marks one of the five worst since the world started its recovery from the 2008-2009 global financial crisis.

“Things have not gotten worse but a lot of uncertainty is putting companies on a wait-and-see mode,” Antonio Fatas, a Singapore-based economics professor at global business school INSEAD, said of U.S.-China talks on trade relations.

“In one week, it looks like they are promising and the week after it looks like they are going nowhere, and so there’s a lot of wait-and-see attitude,” he added, saying the uncertainty is forcing companies to put off investment decisions.

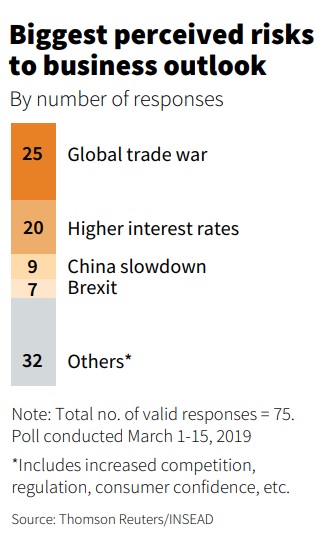

A global trade war was cited as the chief business risk by respondents for the third quarter in a row, though by a smaller margin. Higher interest rates emerged as the second-biggest risk, outpacing a slowing Chinese economy.

A total of 100 companies from a range of sectors responded to the survey, conducted from March 1-15 in 11 Asia-Pacific countries where 45 percent of the world’s population live and 32 percent of the global gross domestic product is generated.

The United States and China have put on hold a planned escalation of their trade war pending negotiations, but the much-awaited conclusion of the latest round of talks has also been delayed though remarks from the two sides have been optimistic.

Global agencies including the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD) have said failure to resolve trade tension could further slow a downward trending global economy.

Regional export powerhouses China, Japan and South Korea all saw exports fall last month, with China and South Korea suffering their worst annual declines in overseas sales in around three years.

The index staying above the neutral point of 50 suggests companies in Asia are not expecting an imminent global recession, but languishing near multi-year lows indicates companies are exerting caution.

“We don’t see a global hard landing as a likely scenario when we look at economic factors such as inflation and credit conditions,” said Young Sun Kwon, an economist at Nomura in Hong Kong. “But there are big uncertainties in politics.”

Lessons from the 2008-2009 global financial meltdown have forced countries to strengthen economic defenses, but factors such as Britain’s planned exit from the European Union and the U.S. Federal Reserve’s uncertain path are posing threats.

With less than two weeks before the March 29 divorce date, British Prime Minister Theresa May’s government is still struggling to push a departure deal with the EU through the British parliament.

In the United States, the Fed has declared a pause in its tightening campaign but economists foresee at least one more increase later this year despite mounting signs of a slowdown in major economies.