(Singapore, 31 July 2023) The Monetary Authority of Singapore (MAS) has launched a public consultation on a revised framework to strengthen surveillance and defence against money laundering (ML) risks in Singapore’s Single Family Office (SFO) sector.

The revised framework will introduce a harmonised class exemption for SFOs with specific requirements to ensure that all SFOs are subject to anti-money laundering controls.

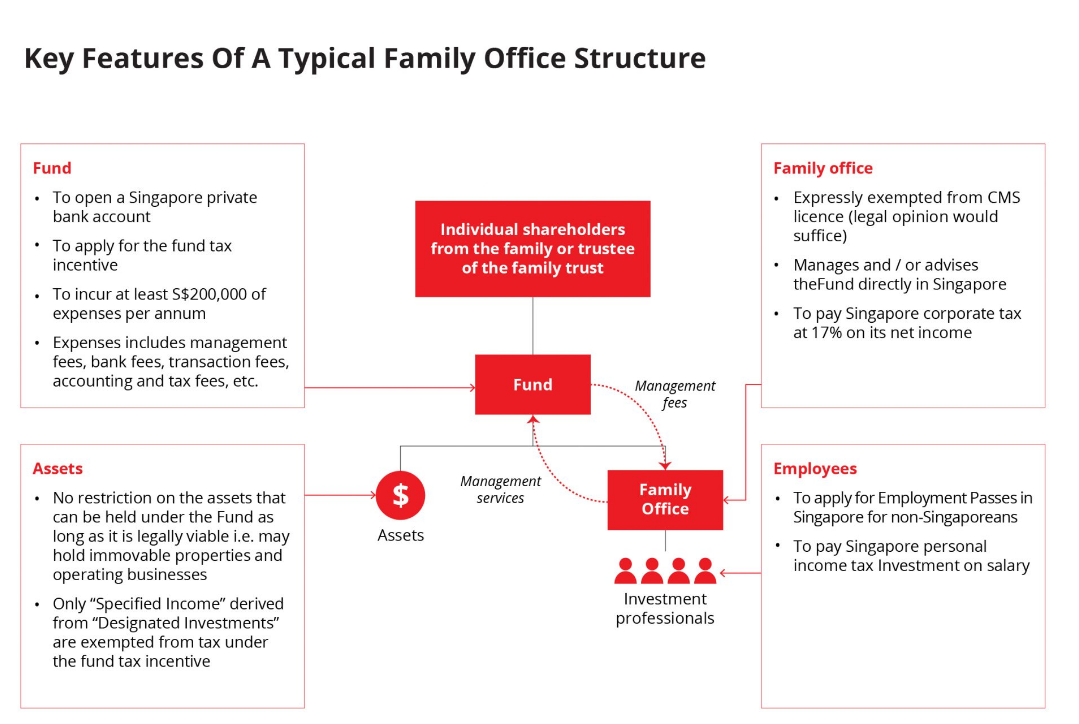

An SFO typically conducts various activities to facilitate the day-to-day management of a family’s assets. The activities involved are diverse and would include investment management, consolidation of the family’s accounts and tax filing. SFOs usually employ small teams of trusted advisers and investment professionals, and also generate indirect employment in Singapore through their engagement of external finance, tax and legal professionals for advice on wealth planning and operational matters.

Currently, as SFOs do not manage third-party assets, they can either rely on existing class exemptions from licensing requirements under the Securities and Futures Act or apply to MAS for case-by-case exemptions. To strengthen surveillance and defence against ML risks in the SFO sector, MAS proposes to harmonise the exemption criteria for all SFOs operating in Singapore.

To qualify for the class exemption, SFOs must be incorporated in Singapore; notify MAS and confirm that it is in compliance with the qualifying criteria under the class exemption when they commence operations in Singapore.

Besides, they have to report annually on total assets managed after the end of each calendar year; and maintain a business relationship with an MAS-regulated financial institution that will perform anti-money laundering checks on these SFOs.

MAS officials say these measures will allow MAS to better monitor SFOs operating in Singapore and address any ML risks in the sector.

Interested parties are invited to submit their comments here by 30 September 2023.

There are reportedly about 200 Single Family Offices (SFOs) in Singapore and the number has grown in recent years.