(Singapore August 11, 2023) Singapore’s Ministry of Trade and Industry (MTI) today announced that the 2023 GDP growth forecast for Singapore has been narrowed to “0.5 to 1.5 per cent”, from “0.5 to 2.5 per cent”.

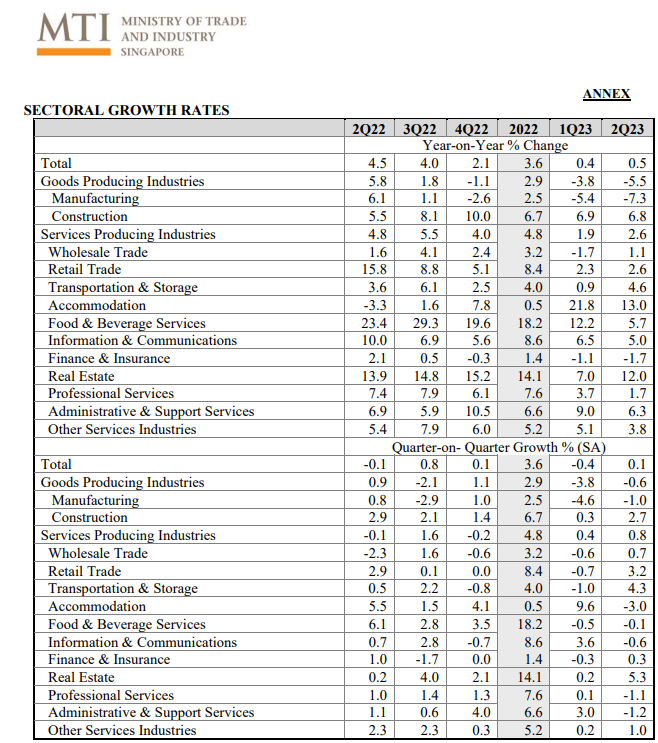

The Singapore economy grew by 0.5 per cent on a year-on-year basis in the second quarter of 2023, extending the 0.4 per cent growth in the previous quarter. On a quarter-on-quarter seasonally-adjusted basis, the economy expanded marginally by 0.1 per cent, a reversal from the 0.4 per cent contraction in the first quarter of 2023.

The accommodation sector expanded by 13.0 per cent year-on-year, the biggest growth among all sectors, extending the 21.8 per cent growth in the previous quarter. Growth during the quarter was supported by a robust recovery in international visitor arrivals. On a quarter-on-quarter seasonally-adjusted basis, the sector shrank by 3.0 per cent, a reversal from the 9.6 per cent expansion in the first quarter.

The real estate sector grew by 12.0 per cent year-on-year, the second biggest growth, accelerating from the 7.0 per cent expansion in the previous quarter. Growth of the sector was supported by the private residential property segment, as well as the commercial office and industrial space segments. On a quarter-on-quarter seasonally-adjusted basis, the sector’s growth picked up to 5.3 per cent from 0.2 per cent in the preceding quarter.

The manufacturing sector shrank by 7.3 per cent year-on-year, worse than the 5.4 per cent contraction in the previous quarter. The weak performance of the sector was due to output declines across all clusters except for the transport engineering cluster. On a quarter-on-quarter seasonally-adjusted basis, the sector contracted by 1.0 per cent, moderating from the 4.6 per cent contraction in the first quarter.

The food & beverage services sector grew at a slower pace of 5.7 per cent year-on-year, compared to the 12.2 per cent expansion in the preceding quarter. Growth of the sector was supported by a higher volume of sales at food caterers, cafes, food courts & other eating places, as well as fast food outlets. On a quarter-on-quarter seasonally-adjusted basis, the sector contracted marginally by 0.1 per cent, extending the 0.5 per cent contraction in the previous quarter.

Since the Economic Survey of Singapore released in May, the performance of advanced economies such as the US and Eurozone has continued to be resilient, although their growth is expected to weaken in the second half of the year. In particular, US’ GDP growth is projected to slow more significantly in the remaining quarters of the year as elevated interest rates and a cooling labour market weigh on personal consumption growth, the survey reveals.

In Asia, China’s GDP growth is expected to moderate in the second half of the year as the post-pandemic recovery in its services activity slows in tandem with deteriorating consumer confidence. Sustained weakness in its property sector, alongside subdued external demand, will also continue to weigh on its growth. However, Southeast Asian economies such as Malaysia, Indonesia and Thailand are projected to remain resilient in the second half of the year on account of the continued recovery in domestic and tourism demand, the survey said.

Overall, MTI’s assessment is that Singapore’s external demand outlook for the rest of the year remains weak. Apart from the expected slowdown in Singapore’s key external demand markets, the global electronics downturn is also likely to be protracted, with a gradual recovery expected towards the end of the year at the earliest. At the same time, downside risks in the global economy remain. First, more persistent-than-expected inflation in the advanced economies could induce tighter global financial conditions, which could then lead to a sharper retraction in global spending and exacerbate the ongoing manufacturing downturn. Second, escalations in the war in Ukraine and geopolitical tensions among major global powers could lead to renewed supply disruptions, dampen consumer and business confidence, as well as weigh on global trade.

Against this backdrop, the growth outlook for the manufacturing sector in Singapore remains weak for the rest of the year. In particular, manufacturing output is expected to be weighed down largely by output contractions in the electronics and precision engineering clusters amidst the global electronics downturn.

Similarly, growth in the finance & insurance sector is likely to be subdued as a result of continued weakness in the external economic environment and restrictive financial conditions. On the other hand, the growth outlook for aviation- and tourism-related sectors such as air transport and accommodation remains positive given the ongoing recovery in international air travel and inbound tourism. Meanwhile, consumer-facing sectors such as retail trade and food & beverage services are expected to continue to expand, supported by resilient labour market conditions and the recovery in inbound tourism.