(12 July, Singapore)In an era where the landscape of family businesses is rapidly evolving, a recent panel discussion was held at the Goodwood Park Hotel yesterday in Singapore, organized by the Hong Kong University of Science and Technology (HKUST), shed light on the challenges and strategies for succession in family enterprises. The panel featured distinguished speakers Richie, Daniel, and Roger, each bringing unique perspectives from their respective generational standpoints. Moderated by Winnie, the discussion provided a comprehensive look into the intricate dynamics of family businesses and their path forward.

Balancing Tradition with Modernization

Richie Eu , Managing Director for Mergers & Acquisitions for Eu Yan Sang (International) Limited, representing the fifth generation of a century-old family business, shared his family’s decision to transition 85% of their company to strategic investors. This bold move was aimed at ensuring the continuity and growth of the business by partnering with entities that align with their values and vision. Richie emphasized the importance of governance and maintaining harmony among 89 cousins, highlighting the critical role of family offices in this process.

“Family offices are not just about managing wealth; they are about preserving the legacy and values that bind us together,” Richie stated.

From a small shop in Perak, the company has grown in 144 years to more than 170 stores across Asia. Here is a look back at its journey through the years. Richie’s family underwent a significant transformation by embracing technological advancements and restructuring their internal systems. They integrated all their operations into a centralized database, enabling them to track products from production in China to the final consumer purchase. This level of transparency and control was essential in attracting and working with strategic investors, Japan’s Mitsui & Co and Rohto Pharmaceutical Co will acquire Eu Yan Sang International in a deal valued at S$800 million (US$594 million).

Richie said, “Rohto is a Japanese company with shared values and a vision for the future. This partnership provided the family business with access to a global network and expertise, which was crucial for their ambition to become a billion-dollar company.”

Preparing for Succession

Daniel Teo, Chairman and managing director of Hong How Group, representing the second generation of his family business, discussed the importance of planning for succession and involving the next generation in the business.

He shared his experience of holding annual family meetings to discuss business operations, personal lives, and philanthropic activities. These meetings foster open communication and ensure that all family members are aligned with the business’s vision and goals.

“Succession planning is not just about passing on the business; it’s about nurturing the next generation’s passion and skills,” Daniel explained.

Daniel’s family business, deeply rooted in the real estate industry, has seen significant growth and diversification over the years. He emphasized the need for the next generation to gain external experience and bring fresh perspectives to the family business. Daniel’s approach to succession planning includes encouraging his children to explore their interests and passions while maintaining a connection to the family enterprise. This strategy ensures that the business remains relevant and innovative, benefiting from new ideas and approaches.

Daniel also highlighted the role of his private museum in preserving and promoting the family’s legacy. The museum, which showcases the family’s art collection providing a platform for the family to engage with the community and foster a deeper appreciation for the arts. “The museum is not just about preserving our heritage; it’s about inspiring future generations and contributing to the cultural landscape of our city,” Daniel added.

The private museum has become a central element in Daniel Teo’s family’s approach to maintaining harmony and fostering a shared vision. Each of Daniel’s children has a role in curating and managing the museum, which helps them develop a sense of ownership and responsibility towards their family’s cultural heritage. This involvement ensures that the values and stories of previous generations are passed down and appreciated by the younger members of the family.

“By involving our children in the museum’s activities, we ensure they understand and appreciate our family’s legacy, which strengthens our bonds and fosters harmony,” Daniel explained.

Strategic Exits and Wealth Management

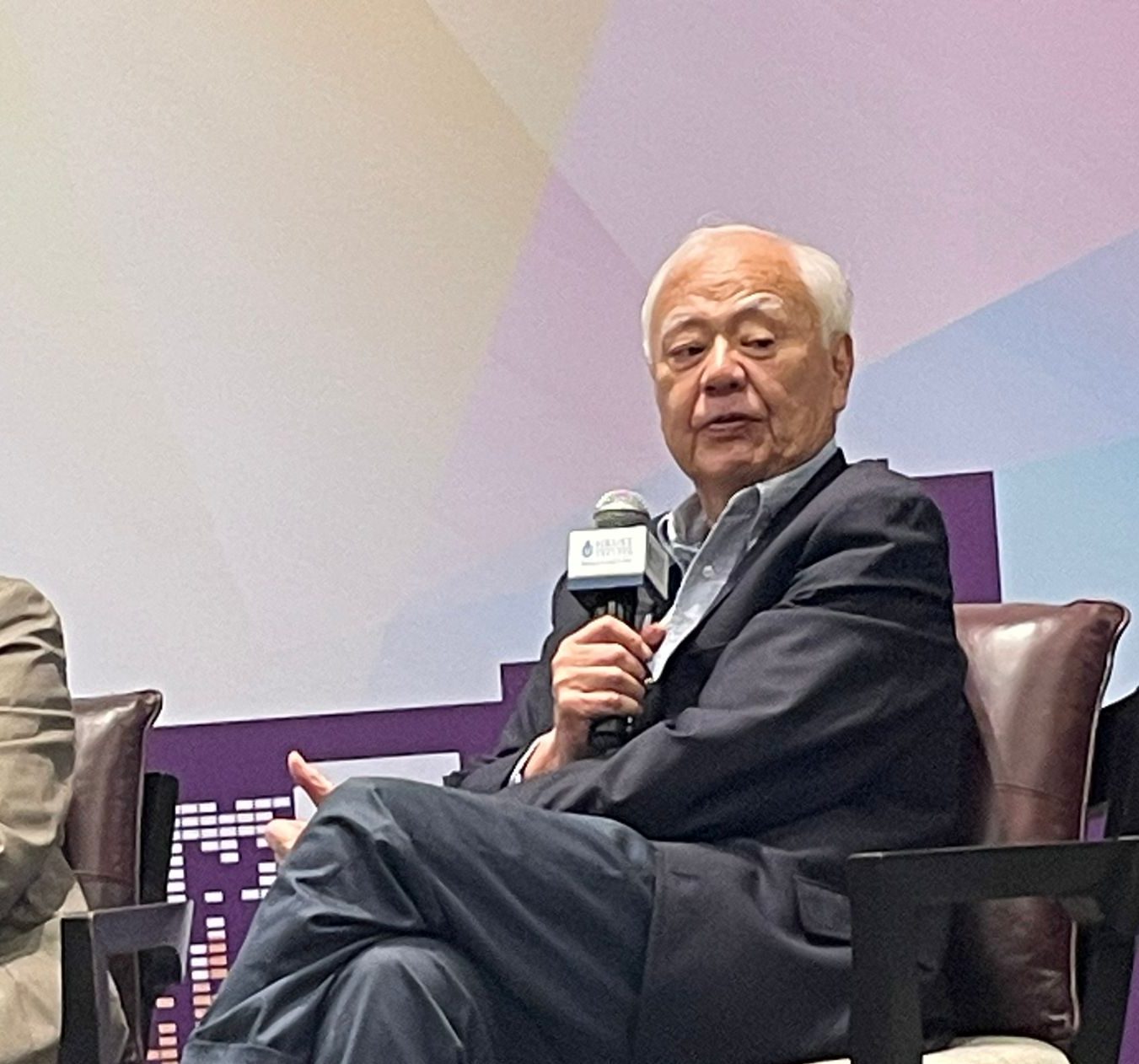

Roger King, Senior Advisor and Founding Director, Roger King Center for Asian Family Business and Family Office provided insights into his family’s complete exit from their business, which was founded by his father-in-law in the mid-1940s. The decision to sell was driven by the need to address the challenges of operating in a capital-intensive and cyclical industry. The sale provided a substantial financial return, but it also posed the challenge of managing newfound wealth.

Roger discussed the importance of dividing the proceeds among family branches and maintaining a portion for philanthropic purposes through a single-family office model. “We emphasize the preservation of family wealth, harmony, and values,” Roger noted, underscoring the need for structured governance in wealth management.

Roger’s family business was a global player in the container shipping industry, facing intense competition and operational challenges. The sale to COSCO, a major Chinese shipping company, was a strategic decision to ensure the business’s survival and growth under a larger, more resourceful entity. The transition from operating a business to managing substantial wealth required a shift in mindset and strategy. Roger highlighted the importance of creating a structured family office to handle investments, philanthropic efforts, and maintaining family harmony through regular meetings and shared values.

From Family Business to Family Office

The panel also explored the evolution from family businesses to business families and eventually to single family offices. This shift is driven by the need for more structured governance and the complexities of managing wealth across generations. As family businesses grow and diversify, the family office becomes a crucial entity that not only manages financial assets but also preserves family values and harmony.

“We are moving into a generation where the family office is the glue that keeps the family together,” Richie observed, emphasizing the importance of adapting to changing dynamics.

Family offices serve as a centralized entity to manage the family’s diverse interests, investments, and philanthropic activities. They provide a platform for professionalizing the management of family wealth and ensuring continuity across generations. The panelists discussed how family offices can support the next generation in pursuing their entrepreneurial ventures, thereby transforming the traditional family business model into a portfolio of diverse investments and activities. This approach allows for flexibility and adaptability in a rapidly changing economic landscape.

A Tale of Two Wealth Hubs

The discussion also highlighted the importance of global collaboration, particularly between Hong Kong and Singapore. These two financial hubs, despite being perceived as competitors, have the potential to complement each other and support the growth of family businesses in the region. “We must view each other not as competitors but as partners in the Asian century,” Roger commented, advocating for greater synergy between these cities.

Global collaboration extends beyond geographic boundaries to include partnerships with like-minded businesses and individuals. The panelists shared examples of how their family offices have engaged in joint ventures, technology sharing, and cultural exchanges. These collaborations not only enhance business opportunities but also strengthen the family’s global presence and influence. By embracing a collaborative approach, family businesses can access new markets, technologies, and expertise, driving their growth and success.

Family Office -The Glue that Keeps the Family Together

Roger King concluded the discussion with a powerful reflection on the role of family offices in the future of family businesses. “We emphasize the preservation of family wealth, harmony, and values. The family office is not just a financial entity; it’s the glue that keeps the family together, ensuring that our legacy is passed down through generations. It’s about creating a structure that supports our family members in pursuing their passions and maintaining our shared values,” he stated. Roger’s comments underscore the critical importance of family offices in navigating the complexities of wealth management and succession planning in today’s dynamic business landscape.

by Melvyn Goh, CEO of Family Fortune Times