(Singapore, 27th September 2024) PayPal is now allowing American merchants to purchase, retain, and sell cryptocurrency through their business accounts, expanding on the payments firm’s already-available consumer offerings.

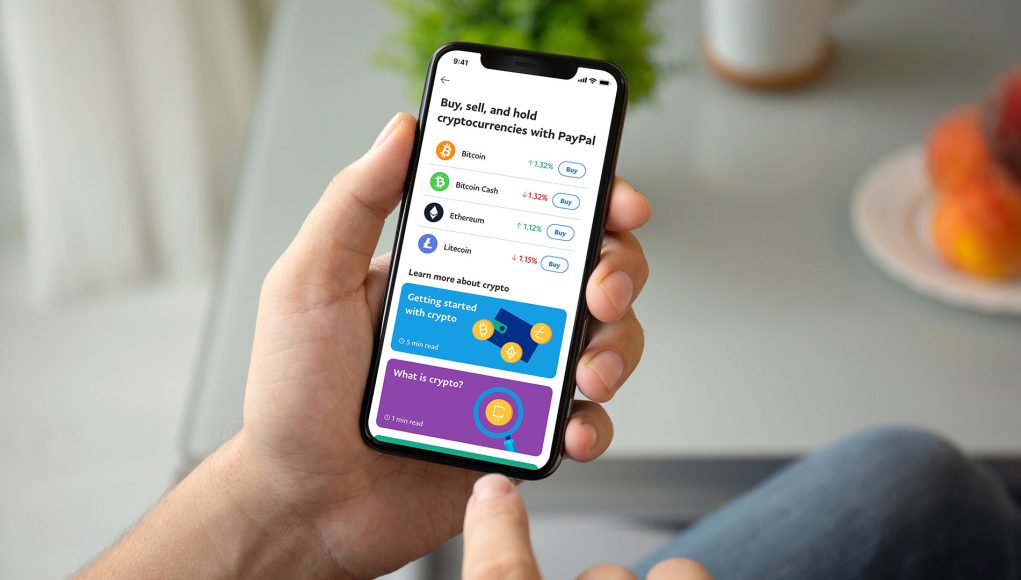

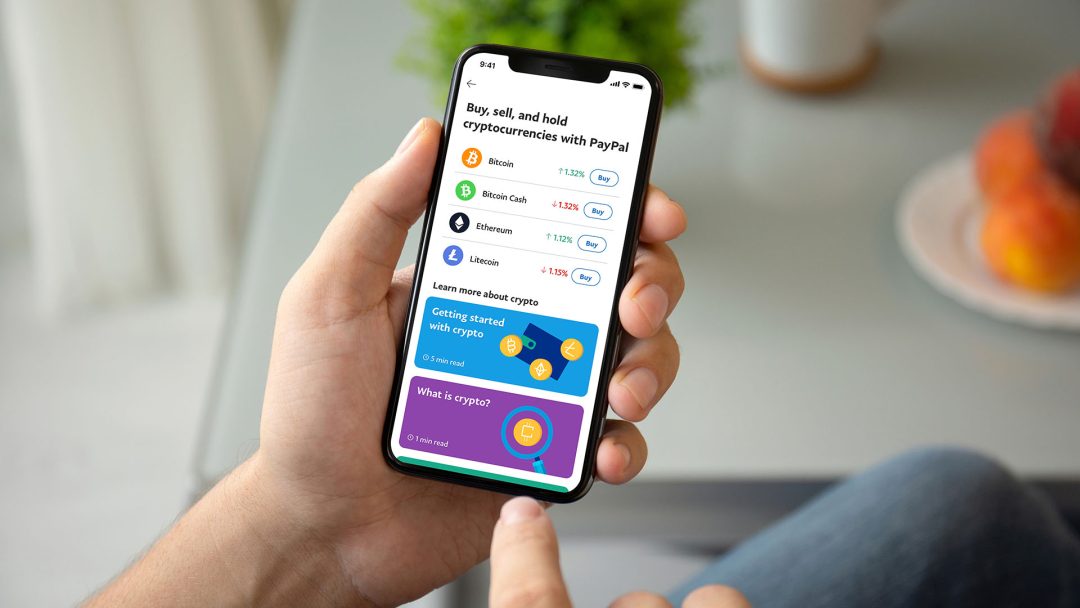

PayPal has allowed consumers to buy, hold and sell digital crypto via its PayPal and Venmo accounts since 2020, and then further committed to digital currency with the launch of its US dollar-denominated stablecoin, PayPal USD, in 2023.

The San Jose, California-based firm has since learned more about how people want to use their crypto, according to Mr Jose Fernandez da Ponte, PayPal’s senior vice president of blockchain, cryptocurrency and digital currencies.

“Since we launched the ability for PayPal and Venmo consumers to buy, sell, and hold cryptocurrency in their wallets, we have learned a lot about how they want to use their cryptocurrency,” said Jose Fernandez da Ponte, the Senior Vice President and General Manager of the Blockchain, Crypto and Digital Currencies (BCDC), in a statement on Sep 25. “Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers. We’re excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly.”

On September 11, 2024, the Chainalysis team released the Global Crypto Adoption Index, with the United States ranking 4th among 151 countries. This ranking showcases the US’s growing acceptance of cryptocurrencies, emphasizing its pivotal role in the global adoption and integration of digital assets within its financial landscape.

Merchants have had many options for accepting crypto, such as BitPay, along with the ability to accept payments from services like Coinbase Commerce.

The BitPay Card is a prepaid Mastercard that lets you instantly convert cryptocurrency into fiat currency. The currency is then loaded onto the card and can be spent globally, anywhere Mastercard debit cards are accepted.

PayPal’s merchant functionality will not be available in New York at launch, the firm said. Businesses will be allowed to transfer the digital currency to third-party eligible wallets, and send and receive supported tokens to and from external blockchain addresses, according to the statement.

Crypto offers investment and financial transaction advantages, yet investors must stay vigilant against crypto fraud.

According to a recent report from the FBI’s Internet Crime Complaint Center on September 9, 2024, losses stemming from cryptocurrency-related frauds and scams surged by 45% in 2023 compared to 2022, reaching over US$5.6 billion, as scammers increasingly took advantage of the speed and irreversibility of digital asset transactions.