(Singapore 28 April 2023) Prices of resale Housing and Development Board (HDB) flats rose by 1% in the first quarter of 2023, the smallest quarterly rise in the past two years and a half, HDB said.

According to the data released by HDB, the Resale Price Index (RPI), which reflects the general price movements in the resale market, rose 1% to 173.6, less than half of the 2.3 increase in the fourth quarter of 2022.

Christine Sun, senior vice president of research & analytics at OrangeTee & Tie, said that the price softening comes amid higher housing inventory. The housing shortage is easing as inventory builds up, with more flats being completed in recent months. Further, the government continued to launch BTO projects and released new flats for sale.

“Moreover, some buyers have taken a step back to reassess their options and review their price offers. A combination of skyrocketing home prices, inflationary pressures, and rising mortgage rates have lowered buyers’ housing affordability,” she said, noting that rising global uncertainties and financial market volatility sparked by the banking crisis and global recessionary fears prompted buyers to be prudent in their home purchasers.

Therefore, more buyers opted for smaller, affordable flats. The number of small flat transactions increased faster than for big flats. As a result, overall price growth slowed since smaller flats constituted a higher proportion of sales last quarter, and small flats usually fetch lower prices, she said.

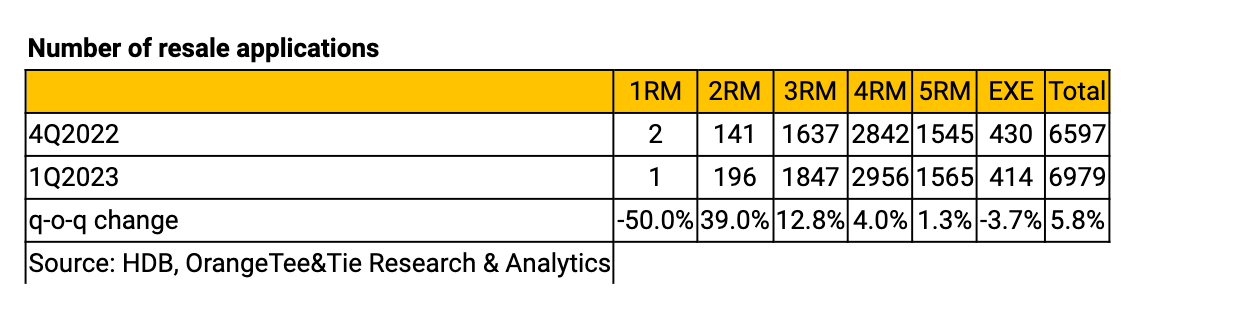

The total resale volume increased by 5.8% from 6,597 units in Q4 2022 to 6,979 units in Q1 2023, based on figures released by HDB. Year-on-year, sales rose marginally by 0.6& from 6,934 units in Q1 2022.

She said rising interest rates, inflationary pressures, and high resale prices have crimped buyers’ purchasing power. As housing affordability takes center stage, small resale flats will continue to find favor with buyers.

She said rising interest rates, inflationary pressures, and high resale prices have crimped buyers’ purchasing power. As housing affordability takes center stage, small resale flats will continue to find favor with buyers.

In addition, since more grants will be given to first-timers purchasing 4-room and smaller flats, demand for small flats will likely rise faster than for big flats.

From August 2023, stricter rules will be imposed for the non-selection of BTO flats. First-timers who lose their priority when they reject HDB’s offer to pick BTO flats will likely turn to the resale market. Therefore, demand for resale flats may increase further in the second half of this year. The total sales volume may reach 23,000 to 26,000 units this year. Resale prices may continue to climb, but at a slower pace of 5-8% in 2023, compared with 10.4% in 2022 and 12.7% in 2021.