(Singapore Sep 12, 2023) One in three local companies expect to increase headcount in the next 12 months, according to the latest Singapore Business Federation’s (SBF) Survey on Manpower and Wages 2023 which was announced today.

The survey, conducted from July 20 to July 31, 2023, received responses from 282 companies across major industries. Among these, 79% were small and medium-sized enterprises (SMEs), while 21% were large companies.

“Businesses expect employment outlook to be positive even though business conditions have weakened, ” said Kok Ping Soon, CEO of SBF.

The survey revealed that 36% of companies expect to increase their headcount in the next 12 months, compared to 29% in the previous year. Correspondingly, while 19% reported a decrease in manpower in the last 12 months, only 10% expect a decline in the next 12 months.

Also, a significant majority of companies (84%) had sent their employees for training in the last 12 months. However, the tight labour market means that companies have trouble in sending their employees for training because there is no backfill. There is also a need to improve the relevance of training to the job for some sectors, the SBF survey reveals.

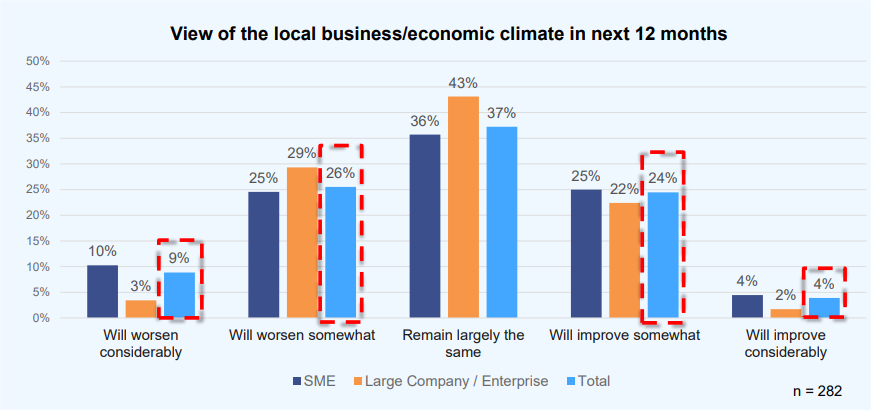

At the same time, more companies (35%) expect business conditions to worsen in the next 12 months than improve (28%). At the sectoral level, more companies in the ‘Information and Communications & Professional Services’ (50%), ‘Retail, Hotels & Food and Beverages’ (45%) and ‘Wholesale Trade’ (44%) expect worsening conditions, while more companies in the ‘Construction & Civil Engineering’ (59%), ‘Real Estate’ (57%), ‘Logistics and Transportation’ (55%), and ‘Banking, Finance, Insurance & Accounting’ (52%) expect that it will remain unchanged.

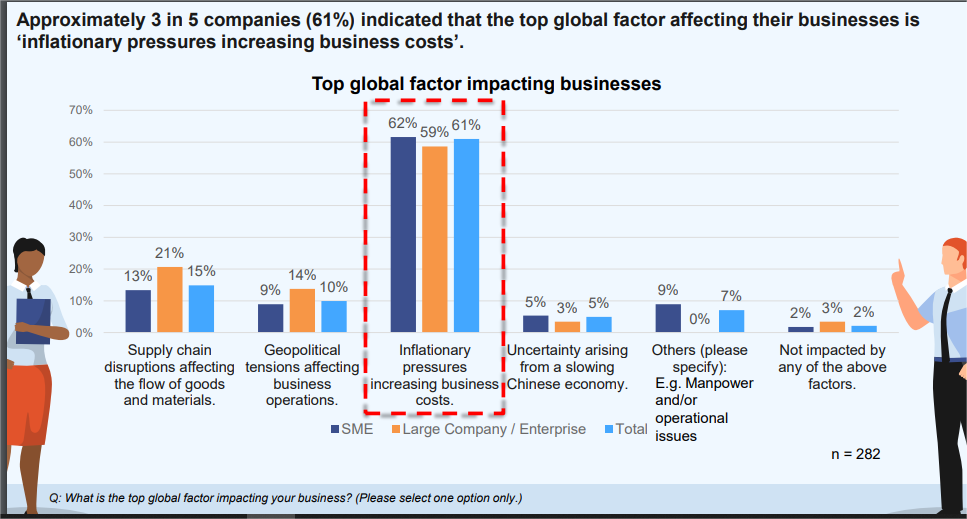

Three in 5 companies (61%) indicated that inflationary pressure leading to increased business costs is the top factor impacting their businesses. At the sectoral level, the 3 sectors with most companies citing this as the top factor are ‘Real Estate’ (100%), ‘Health & Education’ (80%) and ‘Information and Communications & Professional Services’ (72%).

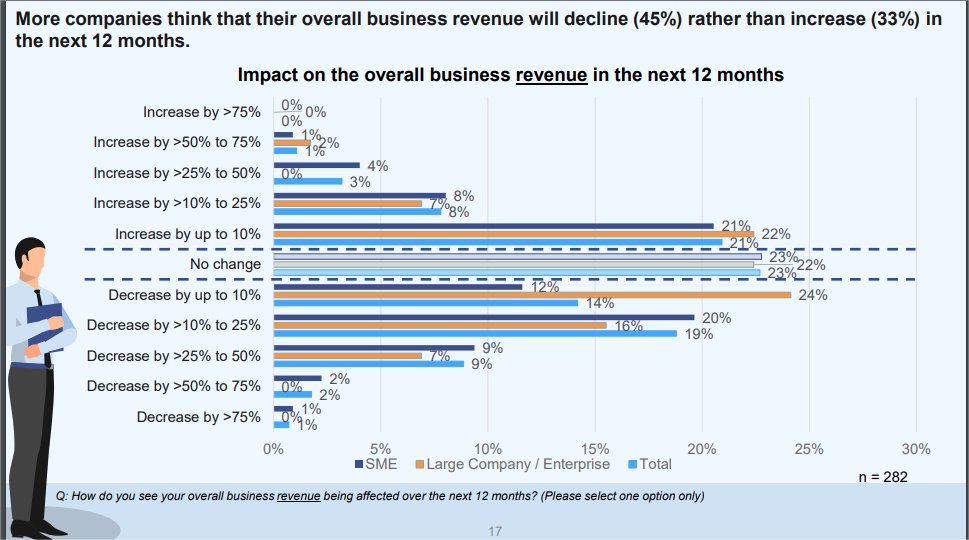

More companies (45%) expect business revenue to decline in the next 12 months than improve (33%). At the sectoral level, more companies in the ‘Wholesale Trade’ (58%) and ‘Construction & Civil Engineering’ (49%) expect declining revenue while more companies in the ‘Banking, Finance, Insurance & Accounting’ (62%) and ‘Information and Communications & Professional Services’ (44%) expect improving revenue.

While there is a mix of expectations in terms of increasing and decreasing revenue, a significant majority of companies (85%) expect business cost to increase in the next 12 months. More large companies (45%) expect cost increase by up to 10%, whereas more SMEs (42%) expect an increase between 10% and 25%.

Despite the weakened economic outlook, employment outlook remains positive. One in 2 companies (51%) had no change to their full-time employees in the last 12 months and a similar number (53%) do not expect a change in the next 12 months.

Twenty-percent of companies experienced an increase in headcount in the last 12 months and expect to further increase in the next 12 months. The top 3 sectors in this category are ‘Banking, Finance, Insurance & Accounting’ (38%), ‘Retail, Hotels & Food and Beverages’ (30%) and ‘Health & Education’ (20%). Conversely, 6% of companies experienced a decrease in headcount in the last 12 months and expect to further decrease in the next 12 months. The top 3 sectors in this category are ‘Construction & Civil Engineering’ (10%), ‘Logistics & Transportation’ (9%) and ‘Retail, Hotels & Food and Beverages’ (9%).

Some 88% of large companies increased salaries in the last 12 months and 86% of them expect to increase salaries in the next 12 months, whereas 73% of SMEs did so in the last 12 months and 62% of SMEs expect to do the same in the next 12 months. On the whole, 61% of companies had increased salaries in the last 12 months and will continue to increase salaries for the next 12 months. This will contribute to increased business costs even as economic outlook weakened.

Some 84% of companies had sent their employees for training in the last 12 months. More employees from large companies have undergone training (46%) compared to SMEs (33%). It is encouraging that a significant majority of companies send their employees for training, although more could be done to encourage SMEs to send more of their employees for training.

However, the tight labor market has made it challenging for companies to send their employees for training due to a lack of backfill. 59% of companies cited ‘limited manpower resources to cover for staff who are undergoing training’ as the top challenge faced when considering sending their employees for training. The top 3 sectors citing this as the key challenge are ‘Real Estate’ (86%), ‘Retail, Hotels & Food and Beverages’ (76%) and ‘Manufacturing’ (62%).

There is also a need to enhance the relevance of training programs for some sectors. About 35% of companies cited ‘training programs not offering practical business applications and outcomes’ as the key challenge.

The top 3 sectors citing this as the key challenge are ‘Banking, Finance, Insurance & Accounting’ (52%), ‘Health & Education’ (50%) and ‘Logistics & Transportation’ (41%).