(Singapore, July 21, 2020) Singapore’s leading government-owned investment company Temasek Holdings announced today that its one-year total shareholder return (TSR) has fallen into negative territory for the 12 months ended March 31, 2020.

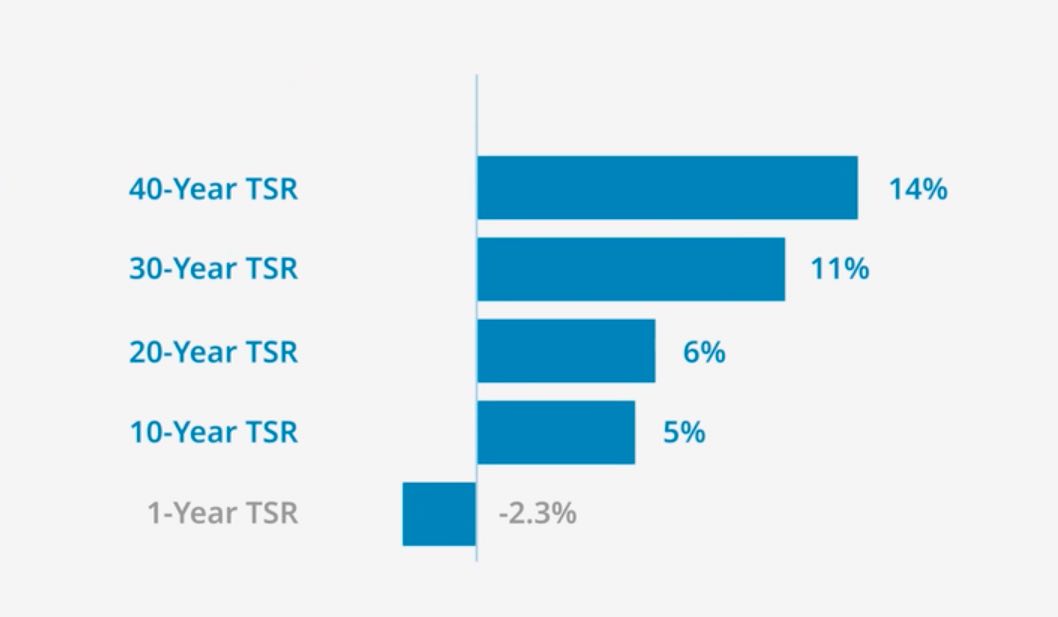

According to its preliminary portfolio performance released today, Temasek’s TSR, which shows the long term value that was created by the company, was -2.3% for the period.

The just-announced TSR is a further drop from the previous fiscal year’s, which had tumbled to 1.49%. TSR is a compounded and annualized measure that includes dividends paid to its shareholder but excludes its shareholder’s capital injections.

Mr Dilhan Pillay, Chief Executive Officer of Temasek International, commented, “Rising geopolitical and trade tensions, as a result of increasing nationalism and protectionism, will create more uncertainties for long term investors and asset owners.”

“These uncertainties are now exacerbated by the immediate, as well as longer-term, impact of COVID-19. However, we may see investors sharpen their focus in some areas, like digitalization and healthcare,” he added.

“These uncertainties are now exacerbated by the immediate, as well as longer-term, impact of COVID-19. However, we may see investors sharpen their focus in some areas, like digitalization and healthcare,” he added.

Based on current unaudited management information, Temasek’s preliminary net portfolio value stood at S$306 billion as of March 31 this year, which is less than the 2019 fiscal year’s $313 billion and 2018’s $308 billion.

NPV is the present value of expected cash inflows from existing assets, minus the present value of expected cash outflows from existing liabilities, plus the present value of net expected cash inflows from existing off-balance sheet contracts.

The state investment firm released these figures ahead of the September release of its final audited annual consolidated group financials and portfolio performance, which was delayed from July as a result of disruptions from the COVID-19 pandemic.

In Singapore, the Singapore Exchange (in consultation with the Accounting and Corporate Regulatory Authority and the Monetary Authority of Singapore) and Inland Revenue Authority of Singapore have also granted extensions of about two months for results announcements, annual general meetings and tax filings.

However, the company said the final portfolio performance results are not expected to be materially different from the preliminary figures.

On the flip side, the company announced that Temasek’s NPV has tripled over 16 years, up from S$90 billion as at 31 March 2004, reported in its inaugural Temasek Review. Its 16-year TSR was a compounded 7.5% from 31 March 2004 to 31 March 2020.

Prior to the onset of the COVID-19 pandemic in the last quarter of the financial year ended 31 March 2020, Temasek’s NPV had been growing steadily and trending well, it says.

“As an investor with a long term horizon, Temasek does not manage its portfolio to short term mark to market changes, by benchmarking against public market indices, or comparing against the returns of other companies,” the announcement says.

However, as a reference to how it has performed over the last financial year relative to market indices in Asia, the Temasek portfolio stayed resilient with a 2.3% decline, compared to the MSCI Singapore Index and the MSCI AC Asia ex-Japan Index, which declined 18.3% and 9.0% respectively, the announcement says.

Globally, the MSCI World Index declined by 5.8%. Most of these declines were the result of the sharp market correction in the last quarter up to 31 March 2020, in response to the onset of COVID-19, the company says.

“As was evidenced during the SARS epidemic and the Global Financial Crisis, Temasek typically outperforms market indices during market downturns,” the announcement says.

Temasek ended the year in a net cash position with a strong balance sheet.

Thus, it says, Temasek has the capacity to work with its portfolio companies to position them for the future. It also stands ready to invest in opportunities arising from volatile market conditions during and post COVID-19 recovery.

“We aim to build a resilient portfolio as a long term investor. On the whole, we are pleased with our performance, despite the sharp correction due to COVID-19. We have a good mix of listed and unlisted investments, a good balance between our portfolio stalwarts, and our new investments into emerging and longer term trends. These help to add to our resilience”, added Pillay.